Medicare Supplement Agent for Beginners

What is the worst Medicare Benefit plan? The most restrictive Medicare Benefit plan in terms of coverage, network, as well as reliability would certainly be an HMO strategy.

Medicare is our country's wellness insurance coverage program for people age 65 or older. Particular people more youthful than age 65 can receive Medicare too, consisting of those with impairments and those that have permanent kidney failing. The program aids with the cost of wellness care, but it does not cover all clinical expenses or the price of most long-lasting treatment.

The 9-Minute Rule for Best Medicare Agent Near Me

If you select not to register for Medicare Component B however after that make a decision to do so later, your coverage can be postponed. You may have to pay a higher month-to-month costs for as long as you have Component B. Your monthly premium will certainly increase 10% for every 12-month duration you were eligible for Part B yet didn't authorize up for it.

If so, you may desire to ask your workers office or insurance firm exactly how enrolling in Medicare will certainly affect you. You might have medical insurance policy coverage under a group health insurance plan based on your or your spouse's existing employment. In this situation you may not need to get Medicare Part B at age 65.

The 8-month duration that begins with the month after your group wellness plan coverage or the work it is based on ends, whichever comes. To help shield your identity, your Medicare card has a Medicare number that's unique to you. If you did not obtain your red, white, as well as blue Medicare card, there might be something that requires to be corrected, like your mailing address.

The Main Principles Of Medicare Agent Near Me

If you have Medicare, you can obtain info as well as solutions online., Application for Enrollment in Medicare Part B (clinical insurance coverage).

This protection includes medications and also added advantages like vision, hearing, dental, and also more. Some individuals with minimal resources and earnings may likewise have the ability to obtain to spend for Component D medication prices. The Centers for Medicare & Medicaid Services (CMS) takes care of Medicare. After you are enrolled, they will send you a Welcome to Medicare packet in the mail with your Medicare card.

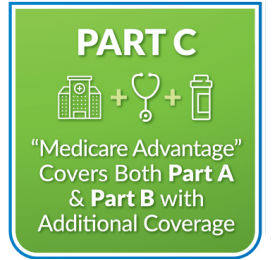

There are 2 major means to obtain Medicare protection: Original Medicare, A Medicare Advantage Strategy Original Medicare consists of Part A (medical facility insurance) and Component B (clinical insurance coverage) - Medicare Supplement Agent. To assist pay for things that aren't covered by Medicare, you can choose to acquire supplemental insurance understood as Medigap (or Medicare Supplement Insurance Coverage).

What Does Medicare Advantage Plans Do?

, which covers all copays as well as deductibles. If you were Learn More Here eligible for Medicare prior to that time but haven't yet enlisted, you still might be able to get Plan F or Plan C (Medicare Advantage Plans).

If you do not buy it when you first become eligible for itand are not covered by a medicine strategy via job or a spouseyou will be billed a life time fine if you try to purchase it later. A Medicare Advantage Strategy is planned to be an all-in-one choice to Original Medicare.

Medicare Benefit Strategies do have an annual limit on your out-of-pocket costs for medical services, called the maximum out-of-pocket (MOOP). When you reach this limitation, you'll pay absolutely nothing for protected solutions. Each strategy can have a various restriction, and the limit can transform every year, to ensure that's an element to think about when purchasing one.

Out-of-pocket expenses can promptly accumulate over the year if you get sick. The Medicare Advantage Plan might supply a $0 costs, yet the out-of-pocket shocks may not be worth those initial savings if you obtain ill. "The very best prospect for Medicare Benefit is somebody who's healthy," states Mary Ashkar, elderly lawyer for the Center for Medicare Campaigning For.